Table Of Content

The move follows the rise in the nil-rate band at which Stamp Duty is payable in England and Northern Ireland from £125,000 to £250,000, announced in last Friday’s mini-Budget. According to some forecasts, mortgage interest rates could reach 6% by early 2023. Only 3.1% of sales agreed have fallen through in the two weeks following the government’s catastrophic so-called mini-Budget on 23 September – broadly in line with the 3% during the same two weeks in 2019. Rightmove said it was ‘very likely’ that asking prices will fall in November and December as they usually do – but it will be important to distinguish between a regular seasonal slowdown and wider factors. With stretched budgets and a preference for living in city centres, the demand for typically cheaper studio flats has grown by 71% compared to last year, says Rightmove. As more buyers return to offices post pandemic, they’re increasingly opting for urban centres.

Home Equity Loan

“Agents report that some movers are pausing until there is more certainty that mortgage rates have stabilised, as well as reviewing how higher costs affect their plans. Larger properties appear to have been the most affected by lower levels of agreed sales. The numbers of sales agreed in June in the mid-market ‘second-stepper’ sector and the top-of-the-ladder sector are 14% behind 2019’s level. However, agents are reporting that competitively-priced homes priced are still attracting buyers due to a shortage of property for sale. A year ago, the same purchase would account for just 32% of average monthly income.

Mortgage Payment Calculator: Canada - NerdWallet

Mortgage Payment Calculator: Canada.

Posted: Wed, 02 Nov 2022 22:47:29 GMT [source]

September: Zoopla Sees Prices Fall In ‘Buyer’s Market’

This is providing further motivation for people to move before the house they want to buy becomes more expensive. There has been widespread speculation that the base rate will rise sooner rather than later in a bid to keep a lid on rising prices – inflation is currently running above 3%, with the official target at 2%. But the Bank is conscious that any increase would filter through to the cost of borrowing, heaping pressure on millions of mortgage customers and potentially threatening the post-Covid economic recovery.

December: Rightmove Reports Annual Price Rise But Sees Fall In November

The annual rate of inflation remained in double digits at 10.5%, although this marked the lowest rise since the start of the year. The company says the prevailing economic climate, coupled with more properties coming onto the market, would likely lead to several month-on-month price falls during the second half of the year. This report is likely to put further pressure on prospective house buyers who are already facing higher interest rates and inflationary increases in everyday spending. The annual increase in property prices had previously slowed from 11.3% in the year to February 2022 to 9.8% in March. The average home in these districts now costs 14.5 times the local annual income, compared with 16.8 times at the start of the pandemic.

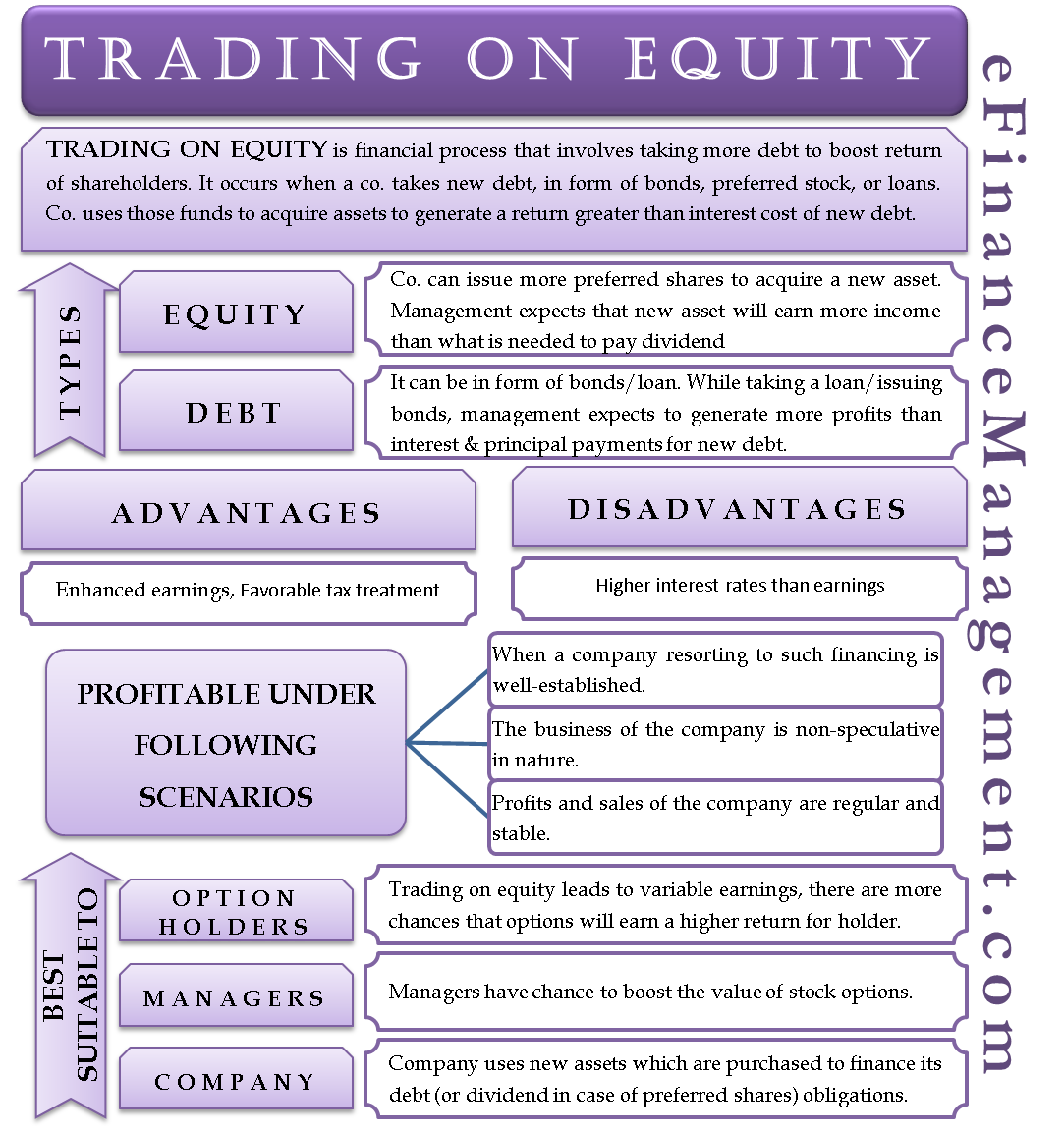

December: All Eyes On This Month’s Bank Rate Decision

If you used a down payment to purchase your home, you likely have some equity in it. To figure out how much equity you have in your home, divide your current mortgage balance by the market or recently appraised value of your home. A home equity line of credit (HELOC) is a revolving line of credit, usually with an adjustable interest rate, which allows you to borrow up to a certain amount over a period of time. HELOCs work like credit cards, where you can continuously borrow up to an approved limit while paying off the balance. The interest rate on home equity-based borrowing is typically lower than that on credit cards and personal loans because the funds are secured by the equity.

Since your home is the collateral for an equity loan, failure to repay could put you at risk of foreclosure. If you're considering taking out a home equity loan, here's what you should know. Home equity loans are a popular choice for homeowners who want to take on some kind of home improvement project. You can use your money however you see fit, but it’s recommended that you reserve it for expenses that help build wealth, like renovations that will grow your home’s value. Home equity is calculated by subtracting how much you owe on all loans secured by your house from your home's appraised value.

Home Equity Loan vs. HELOC

Each lender will evaluate your eligibility differently, so shopping around can help you find the best offer. Your rate will depend on your credit score, income, home equity and more, with the lowest rates going to the most creditworthy borrowers. A home equity loan, sometimes referred to as a second mortgage, usually allows you to borrow a lump sum against your current home equity for a fixed rate over a fixed period. Many home equity loans are used to finance large expenditures, such as home repairs or college tuition. Lenders qualify you based on your income and credit scores and verify your home’s value with a home appraisal. You receive all your money at one time and make monthly installment payments.

FAQs about home equity loans

Rightmove also reported an easing in the annual rate of house price growth to 8.2% in August, down from 9.3% the previous month. Average UK house prices fell in August 2022, their first drop this year, according to the latest market data from Rightmove. Zoopla said that demand for homes in London continues to lag the rest of the UK due to pandemic and affordability-related factors. The capital registered annual price inflation of 4.1% to July, less than half the UK average. Regionally, the South West of England and Wales saw the joint strongest annual house price growth at a rate of 10.6% in the year to July this year.

Yesterday, in a bid to counter steepling inflation, the Bank of England raised interest rates to 1%, the UK’s fourth rate rise in less than six months. The increase means dearer home loans for customers with tracker and variable-rate mortgages in the short term, and more expensive fixed rates in the future. The mortgage lender says average prices grew by 1.1%, or £3,078, in April – this is the tenth month in a row that UK property values have increased, the longest run of continuous gains in six years.

While the East saw the lowest growth for England at 0% – average house prices are now at £346,000. “Buyers continue to remain cautious and many are waiting for better value for money and improved affordability from lower house prices or further falls in mortgage rates before returning to the market. Demand remains 33% lower than 12 months ago, and is in line with figures seen in 2019.

Our partners cannot pay us to guarantee favorable reviews of their products or services.

No comments:

Post a Comment